Quarter 1, 2017

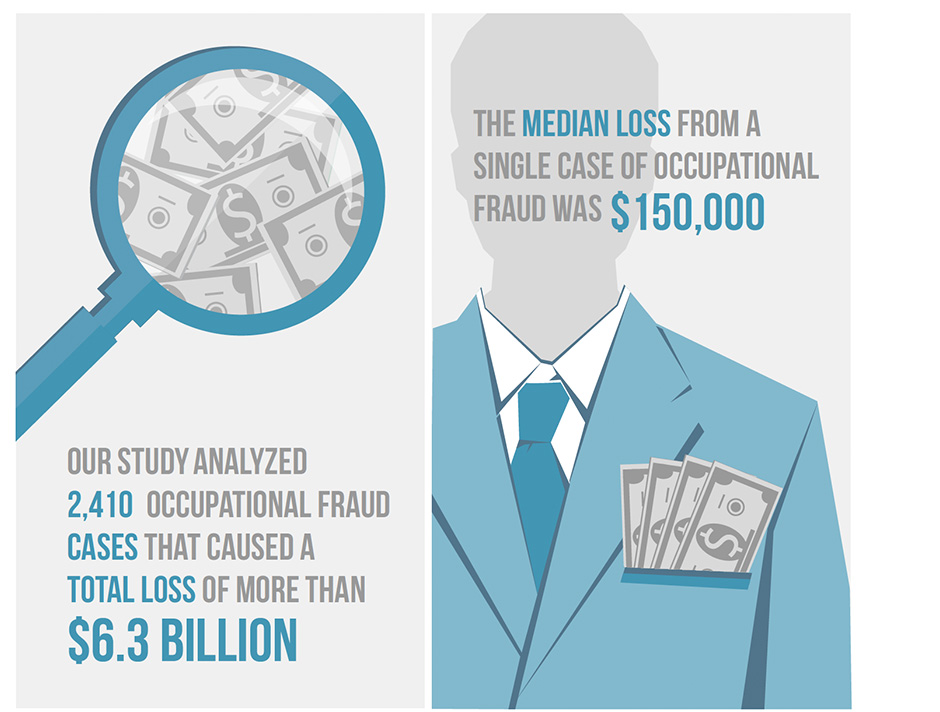

Even if 2016 was a banner year for you, you can't afford to fall victim to fraud in 2017. An infographic from the Association for Certified Fraud Examiners (ACFE) provides a startling perspective on the costs of fraud to a business: the median cost for a single instance of fraud in Canada is $154,000, and more than 23% of all fraud incidents cost the affected company more than $1 million. The ACFE surveyed companies around the world and respondents estimated that a typical organization loses 5% of its revenue to fraud each year.

However, the association offers good news, too: preventive and proactive security measures can dramatically reduce the cost of a fraud incident because such measures help a company catch the crime sooner. Victim organizations that lacked anti-fraud controls suffered two times the median loss.

While no prevention system is ever fail-safe, it is possible to take steps that will help reduce the risk of your business being a target of fraud in 2017. Here are seven steps you should take

- Be vigilant about payment security

Whether you're receiving a payment or making one, security is paramount. For Internet sales, use address and card-verification measures. Fully encrypt all points of payment to reduce the risk of hacking. When making payments, choose methods that have proven security protections in place, such as secure ePayment providers and high-security cheques. - Monitor your business credit report

Credit accounts are often the first place where signs of fraud will appear. Just as you monitor your personal credit, it's imperative to regularly monitor your business credit report for fraud. - Be careful in the hiring process

Sadly, fraud often stems from internal sources. Thoroughly vet new employees, conducting full background checks on anyone who will have access to company funds, customer data or other proprietary information. - Train employees in fraud recognition/prevention

Educate those who work with data, credit and cash about the signs of fraud, as well as the steps they can take to protect your company. For example, train them to recognize the indications that a credit card device might have been tampered with, and stress the importance of shredding documents before disposal. - Adopt and enforce cyber security measures

In addition to keeping up-to-date anti-virus and anti-malware software on your company systems, implement and enforce a strict password policy. Establish clear guidelines for who may access company systems, and implement a Bring Your Own Device policy for any employees who wish to use personal devices to interact with company systems. - Manage cash and credit

Keep a close eye on the movement of cash and credit within your business. Implement checks and balances, such as having one person sign cheques and a second person responsible for balancing the company chequebook — rather than having one person do both. Require approval for expenses and consider using security cameras to monitor inventory storage, credit-processing machines and cash registers. - Be prepared for the worst — consider insurance or fraud-resolution service

Despite your best efforts, fraud may still occur. When it does, having resolution assistance can help your business mitigate financial damages and recover more quickly. Consider fraud-resolution services, such as EZShield®.

Safeguard Premium Secure cheques include state-of-the-art security features, as well as EZShield Cheque Fraud Protection, which extends protection beyond the cheque to provide assistance if fraud does occur. Ask your Safeguard consultant for details.

Fashionable, logoed polo shirts are commonly considered one of the best investments a company can make. Not only do they help reinforce your brand, they also build team unity in the office, on the sales floor and at corporate events. Here are four examples of polo-wearers who can help your company succeed.

The stylish worker:

Whether standing behind a desk, providing service in the field or working in the office, employees look classy and professional wearing personalized polo shirts. Your Safeguard consultant can help you select the right shirts for your needs and have them enhanced with your company logo.

The team player:

One major advantage of polo shirts is that they make great team uniforms. Shirts can also be used to differentiate teams within your organization. Plus, providing your star employees with good-looking apparel is the perfect way to say "thank you" and help them step out in style.

The team player:

One major advantage of polo shirts is that they make great team uniforms. Shirts can also be used to differentiate teams within your organization. Plus, providing your star employees with good-looking apparel is the perfect way to say "thank you" and help them step out in style.

The fan:

Offering promotional apparel to your supporters and customers is an affordable, effective way to show your appreciation while eliciting brand awareness in the marketplace.

To learn more about how polo shirts and other promotional apparel can benefit your business, contact your Safeguard consultant today